Table of Content

News Release Summary, July 7, 2018.

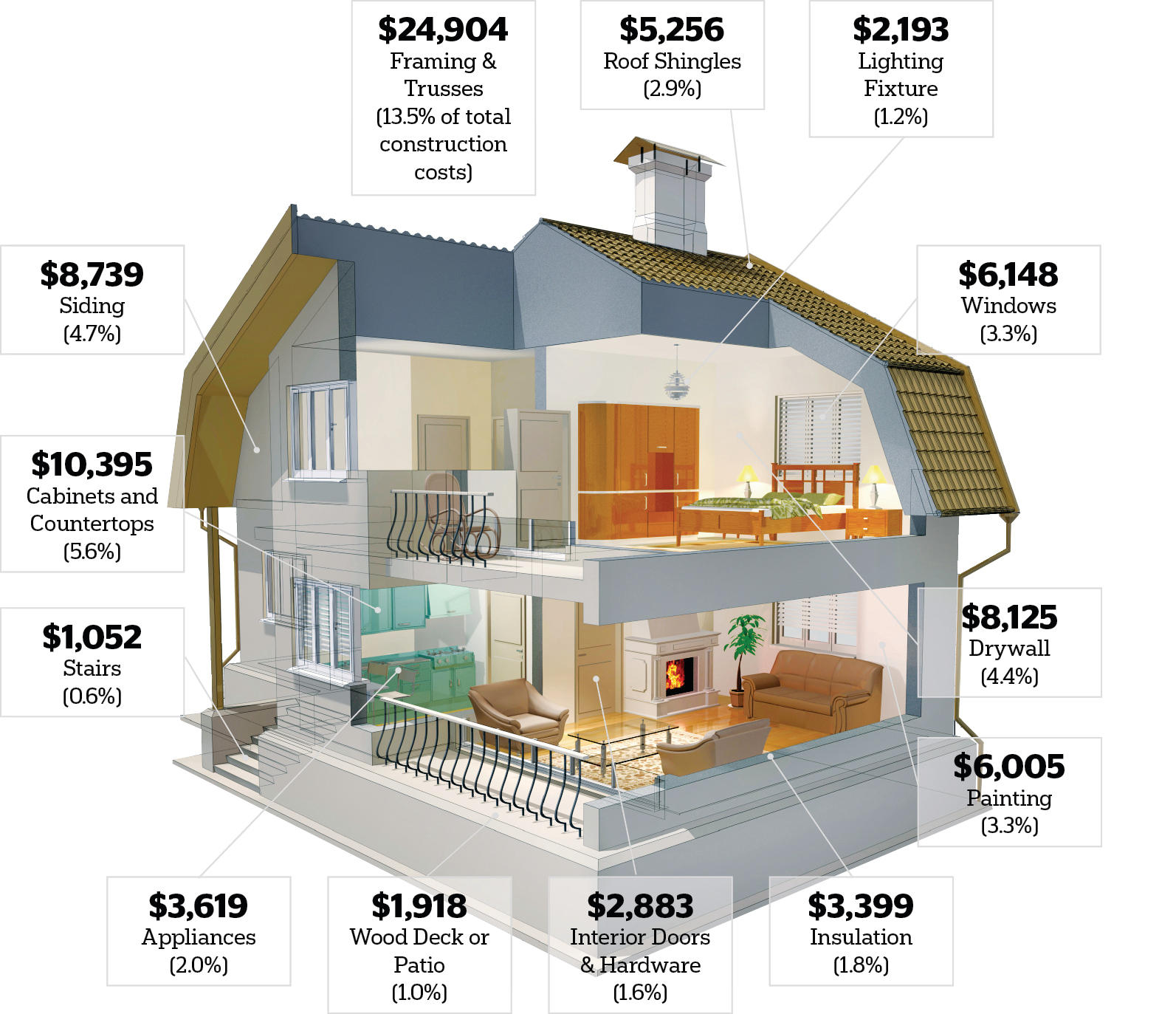

Homeowners insurance rates are impacted by age and size of the home, claim history, cost of construction materials, and also by location. Read on to compare home insurance rates by insurance company, state – even down to ZIP code – and find out what you can expect to pay for the coverage you need. The average home insurance cost is $2,777 per year nationwide for a policy with $300,000 in dwelling coverage and liability and a $1,000 deductible, based on 2022 Insurance.com data. Insurance.com’s annual best home insurance companies ranking lists the top national insurers. Here are the top-rated home insurance companies for 2022, based on Insurance.com’s analysis of average rates, J.D.

Homeowners Insurance Premiums Increased 59% Over The Past Decade, ValuePenguin.com Finds.

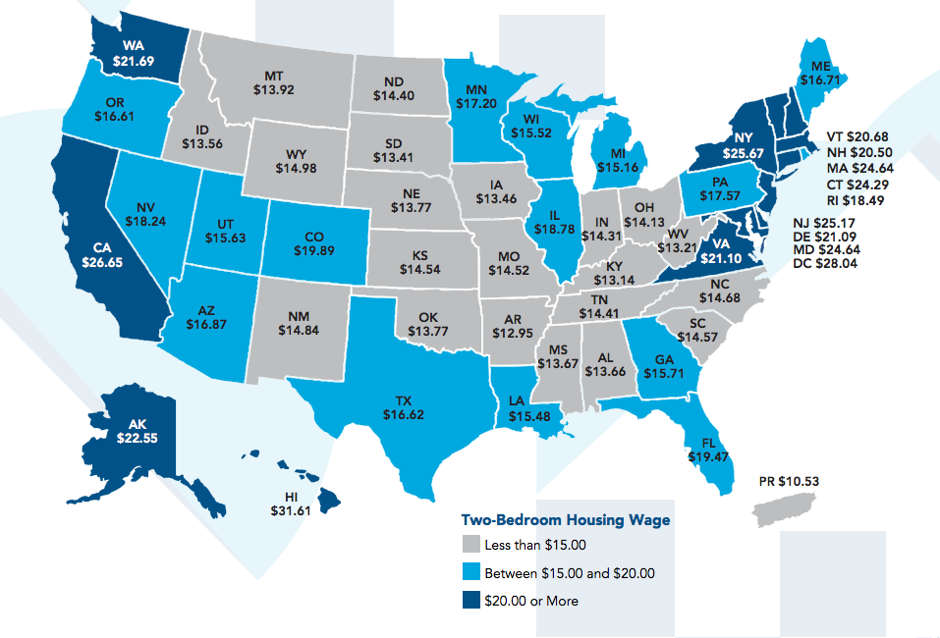

On the other hand, homeowners who live on the west coast often pay lower rates because weather-related property damage claims are less likely. In the table below, you can see the average cost of homeowners insurance in all 50 states and Washington D.C., based on information Bankrate analyzed from Quadrant Information Services. The information below generally applies to health insurance policies available for sale as of Nov. 1, 2017, that took effect for coverage Jan. 1, 2018 through Dec. 31, 2018. Note that "average" prices listed may not reveal lowest costs or highest costs, so the effect on an individual or family often requires a closer look at individual plans. The federal HHS-sponsored web site is intended to make this precise list-price information available to policymakers and the general public. Subsidies for those with annual income up to 400 percent of federal poverty can be calculated by those who are prepared to enter their confidential financial information.

There were 113,500 deaths from unintentional home injuries in 2020, up 21.1 percent from 2019. The overall death rate rose to 34.4 deaths per 100,000 people in 2020. Since 1912, the death rate had been almost unchanged at 28.5 deaths per 100,000 people.

Find average home insurance rates in your state

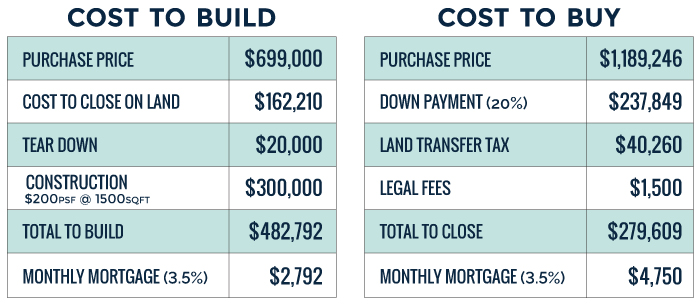

Real estate investors can put the rent up so the tenant pays the increases in costs. This is not a luxury a home owner, occupier has, so it pays to be more vigilant and thoroughly assess the viability of home ownership when interest rates rise, inflation rises too and what would happen if you lost your job. Now there’s another insurance you probably need – income protection so factor that cost in too. Includes broad named-peril coverage for the personal property of tenants.

Remember you can lower your rate by making sure you receive all the home insurance discounts for which you qualify. For example, buying your home insurance from the same company that covers your cars, called bundling, can save you an average of 19%. You can lower your rates by adding storm shutters, updating your roof, and other risk-mitigating changes. You should also consider streamlining the heating system, electrical system, and plumbing in order to lower the possibility of fire and water damage. Learning how to calculate your home replacement cost or value is important because the amount helps you determine how much dwelling coverage to buy. Following the steps below is a good starting point as you look for ways to save on homeowners insurance.

Agency for Healthcare Research and Quality

Using our home insurance calculator below, you can compare average home insurance rates by ZIP code for 10 different coverage levels. The average home insurance ratenationwide is $2,777 a year, according to 2022 Insurance.com data. Of the many things that affect the cost of home insurance, where you live is one of the biggest. Home insurance costs in each state are affected by things like extreme weather and the cost of building materials. There is no shortage of reasons your home insurance rates may have gone up, but the likely culprits in 2022 are rising labor and construction costs due to inflation and expensive natural disasters.

About one in 525 insured homes has a property damage claim due to theft each year. About one in 385 insured homes has a property damage claim related to fire and lightning. About one in 35 insured homes has a property damage claim related to wind or hail each year.

Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. I also understand that my agreement to be contacted is not a condition of purchasing any property, goods or services, and that I may call to speak with someone about obtaining an quote. By clicking Get My Free Quotes and submitting this form, I affirm that I have read and agree to this website'sPrivacy PolicyandTerms of Use. There were earthquakes in Christchurch in 2011 Kiakoura in 2016 and any major event affects homeowners nationwide. Discover tools and resources to help you understand different types of insurance, claims processes, and practical tips to help support you through every stage of your life.

Home insurance companies base rates in part by location, which can go well beyond the state level, says Burl Daniel, CPCU, CIC, CRM, Property and Casualty Insurance Expert Witness, in Fort Worth, Texas. You should buy enough dwelling coverage to match the full replacement cost of your home. It's a good idea to get at least $300,000 of liability coverage to ensure sufficient coverage. You also choose a home insurance deductible amount, which applies to claims for damage to your home or belongings.

We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy. Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

The U.S. standard-setting organization is governed by the chief insurance regulators from the 50 states, the District of Columbia and five U.S. territories. Through the NAIC, state insurance regulators establish standards and best practices, conduct peer reviews, and coordinate regulatory oversight. NAIC staff supports these efforts and represents the collective views of state regulators domestically and internationally. Many factors affect a state's expenditures and premiums, including underwriting costs, repair costs, and state laws. There are also differences in state requirements for insurance coverage, limits, and benefits. In 2019, Hawaii, California, New Jersey and Florida had the highest homeownership costs, based on the percentage of homes in which owners spent 30 percent or more of their income on homeowner-ownership related expenses.

Homeowners in Oklahoma pay the highest insurance rates for $200,000 dwelling coverage. In comparison, the cost of home insurance is the lowest in Hawaii, at $440 a year for the same coverage limits. As you’ll see in the homeowners insurance cost by state chart below, Oklahoma is the most expensive state for home insurance with a rate$2,540higher than the national average for the coverage level analyzed. We show average home rates for three other common coverage levels further down the page. Some of the most common home insurance claims are due to water damage after a burst pipe or roof leak. These are also among the most expensive types of home insurance claims.

Some of the biggest factors that are currently affecting the property and casualty insurance industry are economic changes, like inflation, and climate change, which is increasing the rate of natural disasters. She helps manage the creation of insurance content that meets the highest quality standards for accuracy and clarity to help Bankrate readers navigate complex information about home, auto and life insurance. She also focuses on ensuring that Bankrate’s insurance content represents and adheres to the Bankrate brand. We are building a transparent, customer-powered platform for real people to learn about and buy insurance including auto, home, and renters, with helpful information about pet and life insurance, too. The content on this site is offered only as a public service to the web community and does not constitute solicitation or provision of legal advice. This site should not be used as a substitute for obtaining legal advice from an insurance company or an attorney licensed or authorized to practice in your jurisdiction.

The cost of a benchmark silver plan in these cities is on average 4.4% higher in 2016 than in 2015. Much like your car insurance rates, your homeowners insurance rates may increase for many reasons. While many factors that affect homeowners insurance rate increases are out of your control, there are a few you can control.

The combination of these factors has resulted in some fairly drastic rate increases in 2022. Although home insurance premiums are largely based on personal factors, rates will also depend on your home insurance company. Average rate data shows that some home insurance providers have lower rates than other insurers. This is why it’s important to get quotes from multiple companies before choosing a provider. Below, you can see the average cost of home insurance from some of the biggest and most reputable carriers in the industry. For example, homeowners in southern states generally pay higher rates due to the increased risk of severe weather.